Divestment and SRI

/0x16:1085x708/prod01/channel_34/media/seattle-university/cejs/campus-sustainability/images/2-16-1085X723.jpg)

Divestment at SU: A Case Study

In 2018, Seattle University's (SU) Board of trustees voted to divest from fossil fuels with goals to, "by June 30, 2023, fully divest the marketable portion of the endowment from any investments in companies owning fossil fuel reserves,” and “to achieve a 50 percent reduction by December 31, 2020.” In March 2020, the 50% reduction was reached, nine months ahead of schedule. On June 30, 2023, SU fully divested from fossil fuels.

The purpose of this Divestment Case Study is to share SU's experience with divesture, inspire others and educate on the importance of fossil fuel divestment.

What is Divestment, ESG and SRI?

Divestment is simply is the opposite of an investment. It is the process of getting rid of stocks, bonds, or investment funds which can serve financial, ethical or political objectives.

Environmental, social, and governance (ESG) criteria are the three key factors used to judge the sustainability and ethics of an investment. Socially responsible investing (SRI) describes investments that promote positive social or environmental change. This can include investments in companies that are free from fossil fuel usage, give their employees living wages, etc.

Learn More

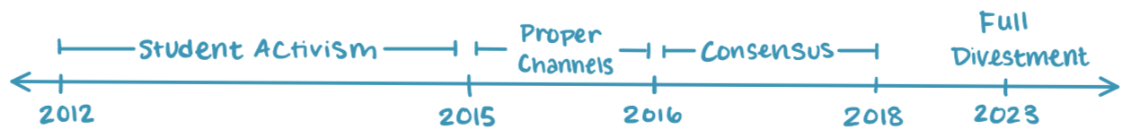

- Nov. 2012: Sustainable Student Action (SSA) forms

To see their divestment page, click here - May 2013: SSA holds divestment rallies, delivers fossil fuel divestment petition to SU's former president, Stephen V. Sundborg, SJ, with 650+ signatures

- Jan 2014: Administration says "no" to formal divestment request from SSA, subsequent faculty and student governmental endorsements

- Mar 2014: SSA president gives Mission Day speech, faculty begins to become more involved

- 2015–2016: Temporary Socially Responsible Investing (SRI) Task Force forms as a response to SSA advocacy

- May 2015: Vatican releases Laudato Si', deepening SU's emphasis on environmental justice

- Dec. 2016: President's Committee for Sustainability submits letter on divestment to former President Stephen V. Sundborg, SJ

- Feb. 2017: Socially Responsible Investing (SRI) Working Group forms

- Mar. 2017:

- SSA students hold the Presidential Address on the State of Divestment with former SU president, Stephen V. Sundborg, SJ, who retorts "Does [divestment] really make a difference?" following a student question

- "A Book Every Hour": SSA students deliver a book on environmental justice every hour to former SU president, Stephen V. Sundborg, SJ

- May 2017: Personal support of former SU president, Stephen V. Sundborg, SJ

- Sept 2018: SU Board of Trustees votes in favor of divestment

- Mar. 2020: SU has reached its halfway point nine months ahead of schedule to divest its endowment portfolio of companies owning fossil fuel reserves by 50 percent

- June 30, 2023: SU reached full divestment from fossil fuels

Future suggestions by SSA members include:

- Reinvestment and Impact Investing: Investments that promote social and environmental good and provide financial return, judged on ESG criteria

- SU Employees Retirement Investing: SU should provide an SRI target fund option to employees and make this the default option

- Advocate for stricter ESG/socially responsible funds standards

- Educate employees and students on divestment and socially responsible investments

- Role of Students: Students are key advocates.

- Engagement: Approval was required at multiple, if not all, levels of the university which requires time.

- Consensus-Building: It is necessary to clearly communicate divestment's connection to the university's mission, vision, and values. One of the biggest convincing factors in SU's divestment was making the case that by not divesting, it is going against our Jesuit Catholic morals.

- Policy: Institutionalizing SRI and ESG policy is helpful, but interacting with the external fund managers continues to be a challenge.

Conversation with SU Finance Team:

The Financial Impacts & Future of Divestment at SU

In January 2022, a group of students affiliated with CEJS and Student Sustainable Action sat down with Wilson Garone, Vice President and Chief Financial Officer, and Bret Myers, Director of Treasury & Risk Management, to talk about SU's divestment journey and the future of sustainable reinvestment.

-1920x745-1130x438.png)